The Anatomy of a Candlestick: Understanding the Basics

Originally developed by 18th-century Japanese rice trader Munehisa Homma and introduced to the West by Steve Nison, candlestick charts provide four key price points within a specific time period, creating a visual representation of market sentiment. Along with candle sticks, we can also use Candlestick Patterns along with RSI and other confluence indicators.

- Open: Starting price for the period

- High: Highest price reached during the period

- Low: Lowest price reached during the period

- Close: Final price for the period

- Real Body: Rectangle between open and close

- Upper Shadow/Wick: Line from high to body

- Lower Shadow/Wick: Line from low to body

Green/White/Blue Body: Closing price higher than opening price (bullish candle)

Red/Black Body: Closing price lower than opening price (bearish candle)

Color conventions vary by platform but consistently represent bullish/bearish sentiment

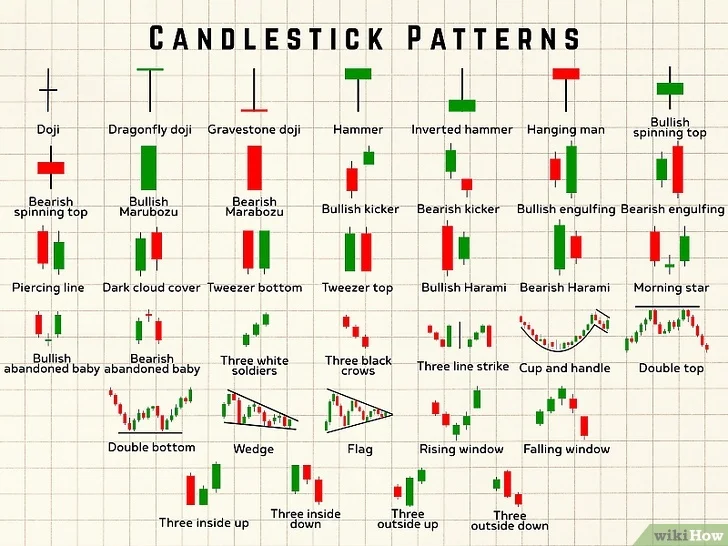

Essential Candlestick Types and Their Meanings

Long Green Candle: Large green body, small wicks – strong buying pressure

Bullish Marubozu: Green body, no wicks – extreme buying dominance

Hammer: Small body at top, long lower wick – bullish reversal after downtrend

Long Red Candle: Large red body, small wicks – strong selling pressure

Bearish Marubozu: Red body, no wicks – extreme selling dominance

Hanging Man: Small body at top, long lower wick – bearish reversal after uptrend

Doji: Open/close nearly identical – perfect balance

Long-Legged Doji: Long upper/lower wicks – high volatility stalemate

Dragonfly Doji: Long lower wick – potential bullish reversal

Gravestone Doji: Long upper wick – potential bearish reversal

Fundamental Candlestick Patterns for Beginners

Hammer: Downtrend, small body, long lower wick – bullish reversal

Hanging Man: Uptrend, small body, long lower wick – bearish reversal

Inverted Hammer: Downtrend, small body, long upper wick – potential bullish reversal

Shooting Star: Uptrend, small body, long upper wick – potential bearish reversal

Bullish Engulfing: Small red candle engulfed by larger green candle – strong bullish reversal

Bearish Engulfing: Small green candle engulfed by larger red candle – strong bearish reversal

Tweezer Bottom: Two candles with identical lows – potential bullish reversal

Tweezer Top: Two candles with identical highs – potential bearish reversal

Morning Star: Long red, indecision candle, long green – strong bullish reversal

Evening Star: Long green, indecision candle, long red – strong bearish reversal

Three White Soldiers: Three consecutive long green candles – bullish continuation

Three Black Crows: Three consecutive long red candles – bearish continuation

Market-Specific Candlestick Analysis

- Earnings candles show large gaps and unusual bodies

- High-beta stocks show more pronounced patterns

- Institutional block trades create anomalous candles

- End-of-quarter window dressing affects patterns

- Session-based patterns (London, New York, Asian)

- Major pairs show cleaner patterns than exotics

- High-impact news creates long-wicked candles

- Central bank announcements generate volatility

- Frequent very long bodies and wicks

- Weekend trading creates Friday/Monday patterns

- BTC patterns often lead altcoin patterns

- Low-cap tokens may show manipulated patterns

Confirmation Techniques and Confluence

Bullish Patterns: Volume should expand on formation

Bearish Patterns: Volume should increase on pattern completion

Divergence: Decreasing volume decreases reliability

- Moving averages provide support/resistance confluence

- RSI divergence confirms reversal patterns

- MACD crosses validate continuation patterns

- Historical S/R levels enhance pattern significance

Primary Trend: Use higher timeframe for direction

Entry Timing: Use lower timeframe for precise entries

Pattern Significance: Higher timeframe patterns have greater importance

Psychological Aspects of Candlestick Trading

- Confirmation Bias: Seeing expected patterns rather than actual ones

- Pattern Overfitting: Finding random patterns in noise

- Revenge Trading: Trading against failed patterns emotionally

- Fear and Greed: Long wicks show fear, long bodies show greed

- Indecision and Resolution: Doji vs. marubozu candles

- Support/Resistance Psychology: Repeated tests create psychological importance

Learning Resources & Development Plan

Recommended Reading: Japanese Candlestick Charting Techniques (Nison), Encyclopedia of Candlestick Charts (Bulkowski), The Candlestick Trading Bible (Alrajhi)

Online Resources: BabyPips School of Pipsology, Investopedia Candlestick Guide, TradingView Education Center

Development Plan: Weeks 1-4: Pattern Recognition → Weeks 5-8: Pattern Application → Weeks 9-12: Pattern Mastery with real trading